Ahead of the much-anticipated Labour Spending Review, this blog reflects on the success of Funding initiatives to help Town Centres in the North-West, as a key region the initiatives were intended to serve.

It also speculates, almost a year into a ‘pro-growth’ Labour Government, what we may expect in terms of further town centre regeneration initiatives – and particularly funding streams, given the increasing recognition that economic stimulation has to be paired with a ‘balancing of the books’.

In 2019, the now previous Conservative Government launched a number of initiatives, aimed at ‘levelling up’, to end geographical disparity within the UK and to breathe new life into town and city centres. This included a series of funding and stimulus initiatives, with around £9 billion of central Government money earmarked to help deliver town centre transformations (including Town Deals, Future High Street funding and High Street Heritage Action Zones). The overall aim was to help centres adapt and move away from traditional retail towards a more nuanced mix of experience, leisure, culture and town centre living; and with an emphasis on place making, heritage and community.

Lichfields experience in helping our clients capitalise on these initiatives is covered in in both our previous

blog; and also within our

Revitalise toolkit for local authorities and town centre stakeholders.

Government Funding for Regeneration in the North-West

There are four key funding streams in the North-West which focus on town centres revitalisation:

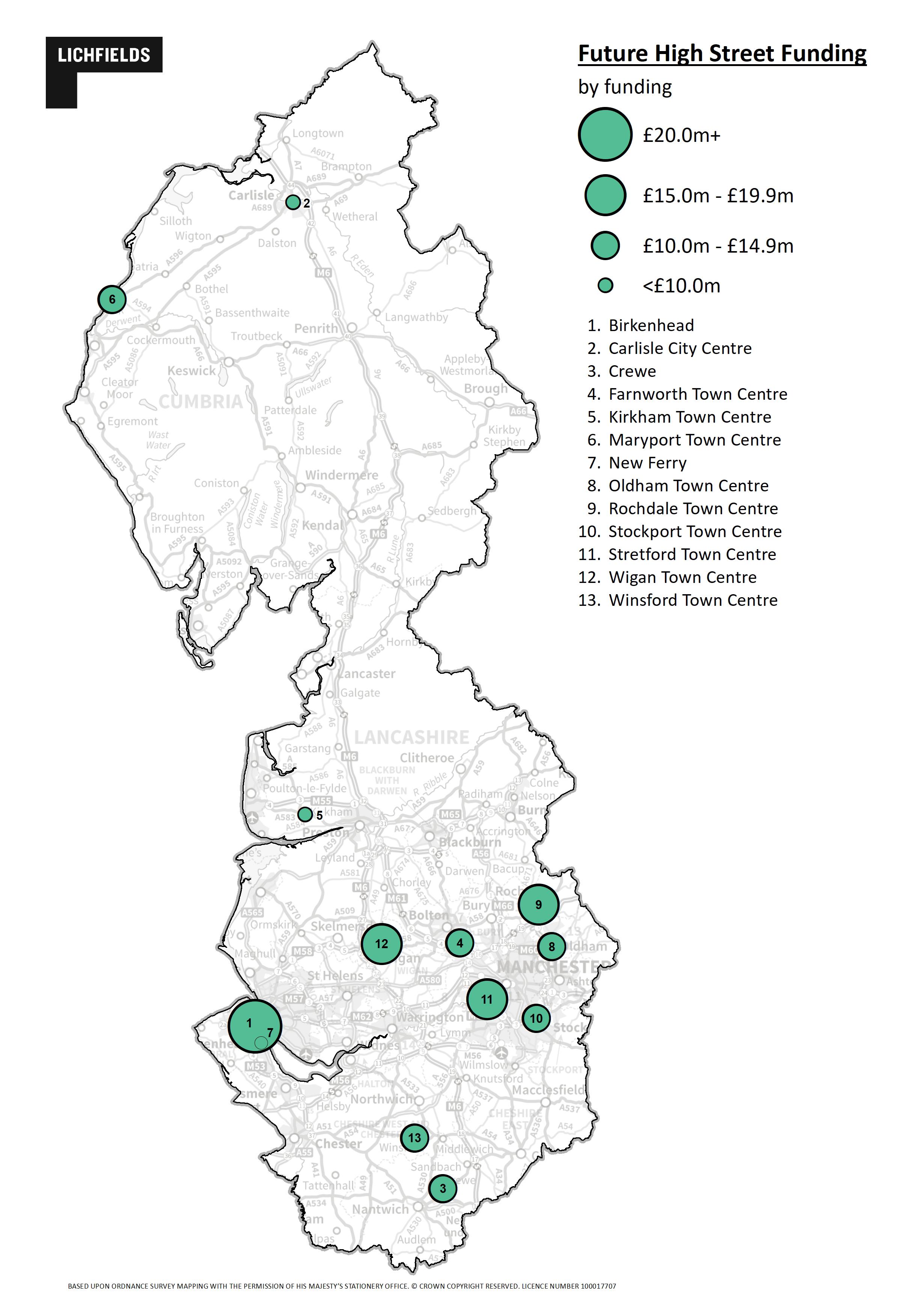

1. The Future High Streets Fund (FHSF)

The Future High Street Fund (‘FHSF’) was designed to support the development of high streets in a way that drives growth, improves customer experience and ensures future sustainability

[1].

Secured through competitive bidding process, 72 applicants were successful nationally receiving a total of £831 million, with allocations varying from £1m to £25m. The FSHF is not intended to focus on retail but to fund capital projects such as improving transport access to town centres or supporting new housing and office space

[2].

In the North-West £168 million was secured across 13 town centres. Key examples of this have included:

In Stockport, the doors opened on the repurposed shopping centre floorspace last month. It sits alongside a wider and impressive package of other town centre regeneration coming forward around the station interchange and within the town centre, which has been driven by the Stockport’s Mayoral Development Corporation (MDC). The MDC initially covered ‘Town Centre West’ since 2019, but in 2024 it was announced to be widening to include ‘Town Centre East’.

Stockport demonstrates the power of the MDC format delivering change, driving regeneration and delivering development.

The FSHF is therefore just one piece of that wider town centre regeneration puzzle. In this case, the MDC model’s ability to deliver change stands out in Greater Manchester, indeed reflecting this, Rochdale, Old Trafford, Bury and Northern Gateway, have recently been announced to set to follow the MDC model.

In Andy Burnhams words, “Approving this in principle is symbolic, and shows that we’re getting on with levelling-up places by ourselves.”

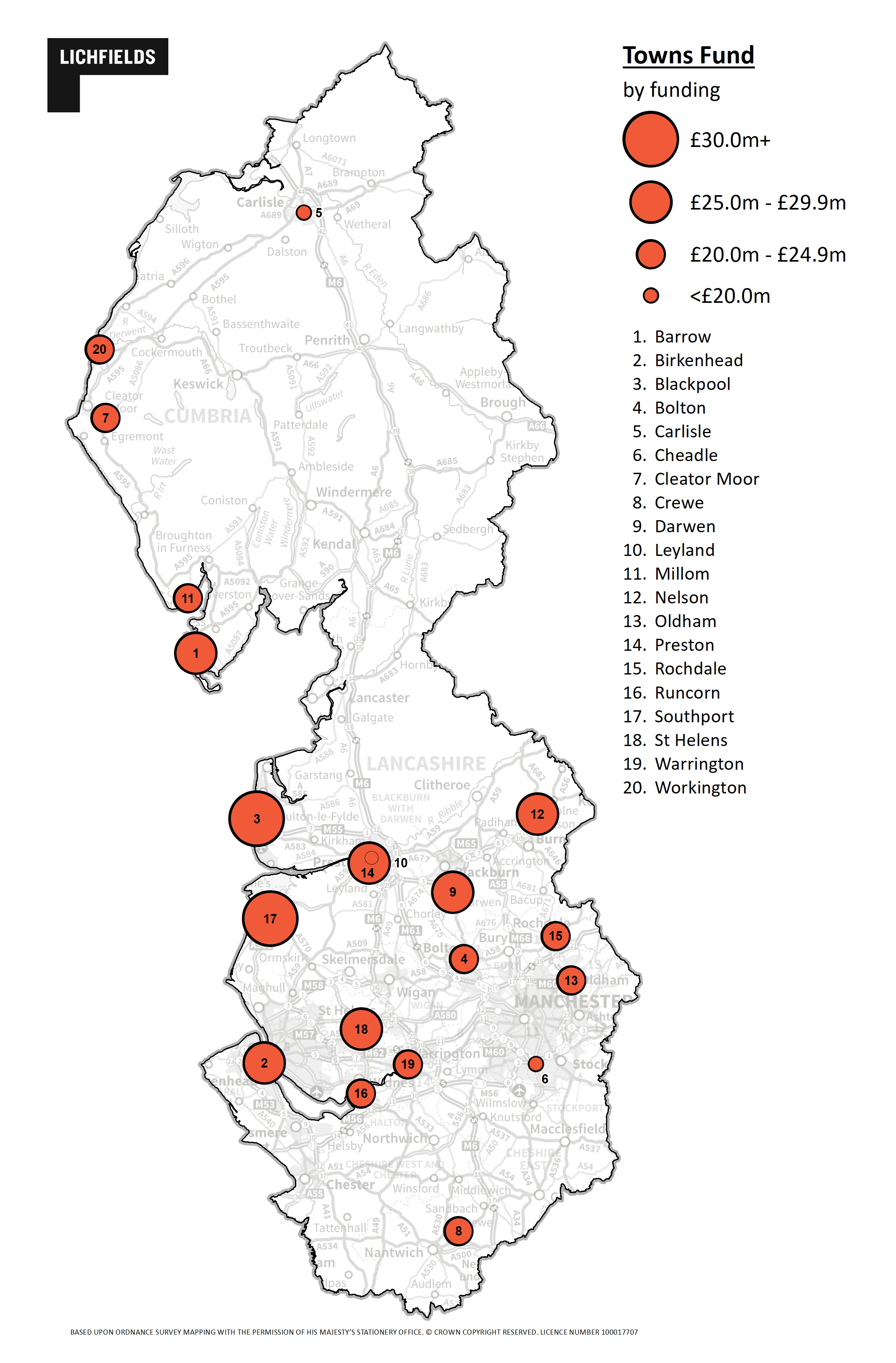

2. Towns Fund

In September 2019, 101 places were invited to put forward proposals for a Town Deal as part of a £3.6 billion fund

[3]. This was designed to provide towns with the tools to design and deliver a growth strategy for their area, contributing to the Government’s objective of rebalancing the national economy

[4] - recognising the role that town centres can play in this.

The North-West secured over £486 million of the fund across 20 allocations. A good example of the use of this Fund is set out below.

Alongside other regeneration projects, including transport improvements, the Towns Funds investment has helped to unlock investment in St Helen’s town centre and has realised potential to create a more diversified all day economy and introduce sustainable spending power with town centre living.

There has, however, been much controversy of the use of £70million funding by St Helens Council and the need to revise proposals to account for inflation costs. This has brought into question whether Local Authorities should put themselves in such a financial position to drive town centre transformation.

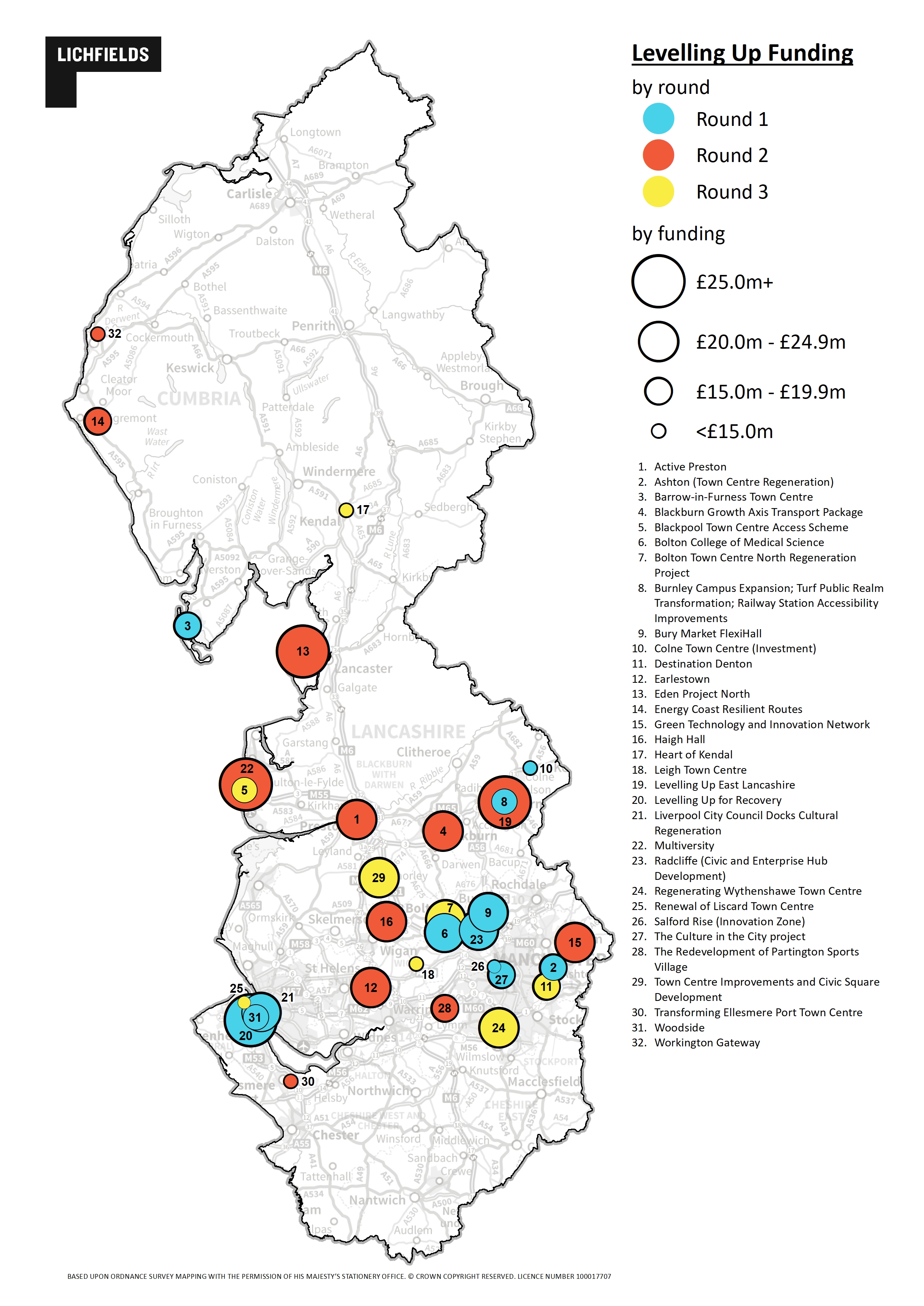

3. Levelling up Fund

A £4.8 billion fund aimed at supporting projects that drive growth in areas of the UK that are economically behind, with a strong emphasis on investment in local infrastructure to support economic recovery.

The North-West secured £570 million across 32 schemes.

-

Wythenshawe – Manchester City Council secured £20 million for regenerating Wythenshawe Town Centre in round 3 of the funding and invested £11.9 million of its own funding. Coming forward as a joint venture with Muse and Wythenshawe Community Housing Group the proposals will deliver 2,000 homes in total, the redevelopment of Wythenshawe Civic Centre, which the city council acquired from St Modwen with a view to regenerating in 2022, plans for a culture hub, food hall, public square, and more than 100,000 sq ft of flexible workspace.

The overall investment is estimated at some £500million when private and public sector funding is combined. The blend of uses proposed, including cultural uses, food space alongside new homes also looks to positively create a sustainable community and which draws in local people and visitors – and hopefully contributes to its success as it comes forward over the next 10-15 years.

4. High Street Heritage Action Zones

Aimed at supporting the preservation and regeneration of historic towns and cities, Heritage Action Zones have provided support since 2017. This led to the £95 million High Street Heritage Action Zone programme aimed at unlocking the potential of 67 historic high streets, nationally and 14 in the North-West region.

The projects aim to support economic, social and cultural regeneration. Projects have transformed disused and dilapidated buildings into homes, shops, workplaces and community spaces:

-

Lancaster: £2million heritage-led regeneration in the Mill Race Area, including the refurbishment of Grade II Listed Grand Theatre, alongside restoring and reinstating historic fabric of other historic buildings windows, shop fronts and signage, elevation treatments such as re-pointing and roofing repairs.

The investment positively reinstates parts of the cultural fabric and richness of Lancaster. This supports making it an attractive centre to visit for future generations and provides a wider draw to the town centre for visitors – ultimately increasing footfall and bringing vitality and viability.

The Impact of Funding: Lichfields’ View

Funding mechanisms appear to have to have the potential for wide reaching positive impacts on town centres in the North-West, both in terms of economic growth and social regeneration. In examples such as St Helens funding has helped provide a central catalyst to kick start and unlock regeneration and bring together private and public sector investment. Albeit the selected locations benefiting from investment, can be at the expense of others that might have ultimately needed it more – and as shown with Stockport there is more sitting behind town centre success than one singular project.

The highly competitive nature in bidding for some of these funds, has however, been subject to significant criticism from a number of leading local authorities who are often required to invest significant resources and public money in developing bids that ultimately may not be successful. The Local Government Association (LGA) estimate the cost of pursuing a competitive bid for funds is often in the region of £30k

[5]. Those that have prepared winning bids clearly have benefited, however these have not necessarily rewarding areas most in need of regeneration funding and often the selection criteria which has determined not only ‘winners’ but equally ‘losers’ has seemed arbitrary. This has been accused by some as “leading to the opposite of levelling up”, where some areas decline further as others allocated funding gain strength

[6].

A further challenge is that schemes have been slower to deliver than expected, beset by inflationary costs and, in some cases project specific issues. The impact of the pandemic on spending has also been cited as key metric which has delayed positive impacts been realised sooner. For those working in planning and development sector uncertainty challenges with timescales and delivery is not necessarily surprising, but critics have noted that when spending from the public purse understanding the readiness of projects should be better understood.

Delays in delivery has also been criticised, despite choosing apparently “shovel ready” projects, Parliamentary review showed 80% of the Levelling Up Fund Round 1 projects were set to miss their March 2024 completion deadline

[5]. This has led to the Government to have to introduce more flexibility around deadlines; and much renegotiations by Local Authorities.

In order to fully understand the benefit arising from the central Government investment, there has also been recommendations to better measure progress with projects, as well as the longer-term impacts for town centres, for example over 5, 10 or 15 years

[5].

Conclusion

Town centre regeneration in the North-West of England has benefited from targeted government funding. With continued investment and collaboration from local authorities and key town centre stakeholders, the North-West town centres can emerge stronger, more sustainable, and more vibrant than ever before.

The Future High Streets Fund, High Street Heritage Zones and Town Deals are from the new Labour Government’s perspective committed projects with positive legacies, but which financial link is coming to a close. The

Autumn budget confirmed previously committed funding for core Levelling Up Fund projects – providing £1.0 billion will be delivered in 2025-26. It also committed to reforming growth funding with Phase 2 of the Spending Review, including rationalising the number of funds and moving away from competitive bidding for funds and supporting local leaders to drive growth.

Any plans emerging are likely to seek to learn lessons from the previous approach. If funding streams for town centres are rationalised, perhaps other delivery vehicles for regeneration - Development Corporations, Mayoral Development Zones, Compulsory Purchase, Local Development Orders - will increase in prominence.

We will await further updates in the Spending Review - either way the North-West continues to be a region with great potential.

Lichfields toolkit –

Revitalise – provides local authorities and other stakeholders with a range of services to help transform town centres across the country, combing town centre and economic expertise. Revitalise is designed to:

-

develop a robust evidence base, informing tailored interventions to unlock a centre’s potential

-

provide a strategic framework for new investment which responds to the opportunities identified

-

develop compelling business cases and bids to unlock funding and deliver change

-

assist stakeholders in delivering the new investment needed to transform town centres

Please do get in touch if you would like to discuss any of your potential town centre projects.

Footnotes

[1] Future high streets fund

[2] Debate on regeneration of city, House of Commons Library, October 2024

[3] https://townsfund.org.uk/

[4] Towns Fund prospectus

[5] Levelling up funding to Local Government, House of Commons Committee of Public Accounts Twenty-First Report of Session 2023–24, March 2024

[6] Supporting our high streets after COVID-19, House of Commons Levelling Up, Housing and Communities Committee, December 2021